Why the US Never Got a WeChat?

From WeChat’s billion-user ecosystem to Paytm’s UPI surge, super apps thrive where payments infrastructure and consumer habits align. But in the U.S., cards and specialized apps still rule.

This week’s article is a step outside my usual deep dives on fintech concepts, but it stays very much within the neighborhood. Super Apps begin with one core service, and use payments as an enabler to expand into additional offerings. I was curious to explore WeChat and explored it a bit over the weekend and that’s where the idea to analyze Super Apps started. So let’s dive right in…

What is a Super App?

A super app begins with a single everyday function such as messaging (WeChat), ride-hailing (Grab or Gojek), or payments (Alipay). Over time, it adds services like bill payments, food delivery, travel bookings, shopping, and chat all inside one app.

In 2025, WeChat had about 1.34 billion monthly users and over 4.1 million mini-apps that let people order coffee or shop inside WeChat without downloading anything else.

Alipay, with a similar user base, remains rooted in payments and expanded into areas like lending and insurance.

In Southeast Asia, Grab recorded around $5.4 billion in on-demand GMV in Q2 2025, with 46 million monthly transacting users, showing how ride-hailing morphed into a broader ecosystem.

In India, Paytm processed over 12.4 billion UPI transactions in the first half of 2025, and its wallet handled around ₹4.4 trillion (~$53 billion) in Q2.

These platforms show how super apps become digital hubs for daily life.

What does a successful Super App look like?

A successful super app has three clear traits:

Daily use: People open it many times a day.

Trusted payments core: For example, WeChat Pay and Alipay both process multi-trillion-dollar transaction volumes each year.

Large partner ecosystem: WeChat’s 4.1 million mini-apps serve about 450 million daily users.

This mix of regular engagement, payment trust, and deep integrations makes the app the default place to socialize, shop, and pay.

By contrast, no U.S. platform hits this mark. Cash App, for example, had about 57 million monthly active users in 2024 and processed $282 billion in inflows, while Venmo handled roughly $331 billion in 2023 with 62 million users. But both remain narrow, focused mainly on peer-to-peer payments and simple banking, not broader utility or integration.

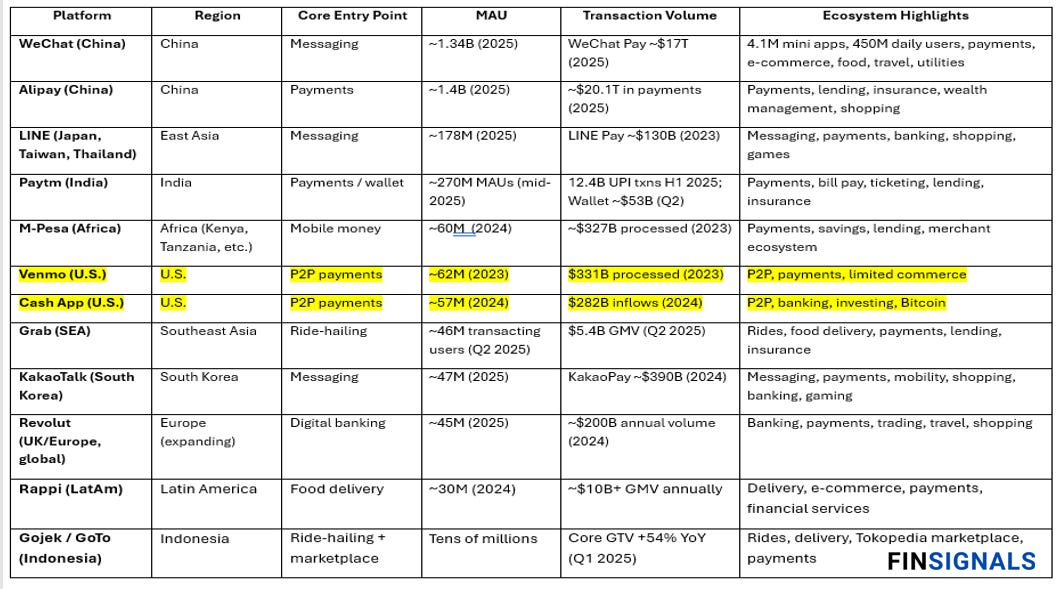

The table below compares leading global super apps in 2025, ranked by monthly active users, highlighting how U.S. players like Cash App and Venmo stack up against Asian and emerging market leaders.

Key Takeaways:

China leads: WeChat and Alipay dominate with over 1.3–1.4B users each and tens of trillions in annual transactions.

India and East Asia: Paytm (270M MAUs) and LINE (178M MAUs) are significant regional players.

U.S. lag: Venmo (~62M) and Cash App (~57M) are big locally but much smaller in reach and service scope.

Emerging regions: M-Pesa, Grab, Gojek, and Revolut show strong regional adoption but remain far from China’s scale.

Why Asia dominates in Super Apps?

The data in the table above shows that Asia has been the clear forerunner in launching super apps at scale. Let’s examine the factors that made this possible.

Addressing Unbanked Populations:

In Southeast Asia, around 73% of adults lack access to traditional banking. In Indonesia alone, more than 90 million people remain unbanked. Super apps like Grab, Gojek, and Paytm filled this gap by providing digital wallets, peer-to-peer transfers, and bill payment tools. For many, these apps became their first point of access to the financial system, bypassing traditional banks entirely .

Mobile-First, Convenience-Driven Markets:

Asian markets are mobile-first. Smartphone penetration in Southeast Asia exceeded 80% in 2023, compared to just 47% a decade earlier. Limited device storage and reliance on low-cost Android phones made “all-in-one” apps especially attractive. A Rapyd survey (2024) found that 57% of users preferred multiple services in one app, and 56% said super apps saved storage space, with adoption strongest among millennials and Gen Z .

Supportive Payments Infrastructure:

Governments across Asia actively promoted digital payments. In India, Unified Payments Interface (UPI) surged past 20 billion transactions in August 2025 making it the backbone of Paytm’s super app ecosystem. In China, QR-code standards endorsed by regulators helped WeChat Pay and Alipay reach ubiquity, with over 90% of urban Chinese consumers using mobile payments daily .Limited Western Competition in Key Markets

In China, restrictions on global platforms such as Google, Facebook, and YouTube created a unique vacuum. Domestic players like Tencent (WeChat) and Ant Group (Alipay) were able to scale into social, payments, and commerce without foreign competition. This gave them a first-mover advantage and the ability to embed themselves deeply into everyday life for over a billion people .

Why the US never built Super Apps?

High Banking Penetration and Established Financial Infrastructure:

Unlike Asia, where large populations were unbanked, the U.S. has long been a heavily banked society. it is estimated that only 4-4.5% of U.S. households are currently unbanked, compared to 73% of adults in Southeast Asia lacking access to formal banking. Most Americans already had checking accounts, debit cards, and credit cards. By 2024, card networks like Visa, Amex, Discover, and Mastercard processed $10.1 trillion in volume, and debit and credit penetration exceeded 80%. This mature system meant there was no urgent demand for all-in-one wallets like Alipay or Paytm.Step-by-Step Digital Transition:

Asia leapfrogged into mobile because smartphones were the first internet touchpoint for hundreds of millions of people. The U.S. followed a slower, layered path: physical banking → websites → smartphone apps. By the time mobile wallets grew globally, U.S. banks and fintechs already offered functional apps for transfers, bill pay, and deposits. That diluted the case for a single app, since consumers were used to managing services across multiple apps that worked well enough.Lack of Unified Payment Rails:

India’s UPI processed over 20 billion transactions in August 2025, while China’s QR-code standards allowed WeChat Pay and Alipay to reach near-universal adoption. The U.S., in contrast, remains tied to a fragmented set of systems: card networks, ACH, FedNow (launched in 2023), and The Clearing House’s RTP. This patchwork raises merchant costs and makes it harder to build ecosystems around one common rail.Consumer Habits and Incumbent Apps:

U.S. consumers are comfortable with specialized apps—Lyft for rides, DoorDash for food, Chase for banking, Amazon for shopping. With abundant storage and reliable broadband, there is little friction in juggling multiple apps. A 2024 Rapyd survey found only 35% of U.S. consumers preferred a single app for multiple needs, compared to 65% in Asia. With strong incumbents already entrenched, super apps had no clear opening.Structural Barriers: Card Dominance, Gatekeepers, and Regulation

The U.S. payments landscape is dominated by cards, which remain the backbone of loyalty programs and merchant relationships. App stores add another hurdle: Apple and Google charge 15–30% fees on in-app payments, discouraging embedded ecosystems like WeChat’s 4.1M mini-apps. Finally, antitrust scrutiny makes bundling risky—Meta faced pushback for linking Facebook, Instagram, and WhatsApp, while Apple faces lawsuits over its App Store. Any U.S. company attempting to build an “everything app” would face immediate regulatory resistance.

Are Super Apps even needed in the US?

In my opinion-System-wide, no. The U.S. consumer stack already works with specialized apps, strong card acceptance, and OS-level conveniences. The friction of juggling apps is lower here than in many mobile-first markets.

Situationally, yes. In US case, specialized apps over super apps makes more sense. There are specific areas where a bundled, payments-anchored experience is valuable:

Retail memberships are the closest thing to a super app. Big stores keep packing more under one roof: delivery, gas discounts, easy returns, streaming, and even money perks. Walmart+ is a clear example with a growing bundle tied to how much you spend.

Phone’s wallet is becoming the hub. Apple Wallet and Google Wallet already hold cards, transit passes, car or home keys, event tickets, and even digital IDs in some states, and they work at many TSA checkpoints. It feels like a built-in “super app” on the phone, not a separate third-party app.

Complex areas benefit most from one app. Healthcare, public benefits, campus life, and getting around town are messy because they mix ID, payments, schedules, and messages. Putting those pieces in one place cuts steps and confusion. The goal is smoother service, not an app that does everything for everyone.

I’m not sure if I want DoorDash selling me insurance while I’m ordering dinner. But they’ve already tried buy now, pay later for food deliveries, so offering small loans isn’t that unrealistic. They already handle payments, know what and how often you order, so adding credit could be a natural next step.

Imagine Hinge or Bumble letting you book a restaurant right from the chat. That makes sense if it removes the extra step of leaving the app to make plans. Or maybe agents will do that. And will change this whole user facing app experience as we know it. Maybe Apps won’t even exist in the future, well it did let my imagination fly a bit here and will stop it here.

What feels more likely in the U.S. is not one app doing everything, but each app adding the next logical step in the customer journey.

What do you think would you be up for buying insurance if Door Dash offers or if Hinge let’s you make a restaurant reservation?

Personally, I’m not sure. Do I see a need? No, not really. But would I be open to trying out? Maybe. I think I like the separation I have with having a specialized app for different needs. I don’t really want them all in one.

References

Fintech Convergence Council – Financial Inclusion Report

#SuperApps #Fintech #Payments #WeChat #Alipay #Grab #Gojek #Paytm #CashApp #Venmo #AppleWallet #GoogleWallet #WalmartPlus #BNPL #DigitalPayments #ConsumerBehavior #UPI #FedNow #RTP #FinancialInclusion

Really enjoyed this breakdown on why super apps flourish in Asia but not in the U.S. The point about consumer habits struck me, here people are fine juggling multiple apps, while in Asia the leapfrog to mobile-first made “all in one” apps natural. Personally, I’ve always liked WeChat because of its seamlessness. Even though the U.S. makes true super apps unlikely, I sometimes wish we had that kind of integrated experience here.